You try to make sustainable choices, like buying compostable plates. But now you hear about a massive tariff that will make these eco-friendly products much more expensive.

The U.S. imposed tariffs1 of up to 540% on Chinese fiber-based tableware2 after determining that these products were sold at unfairly low prices due to Chinese government subsidies, which harmed American manufacturers. This action effectively prices many of these imports out of the U.S. market.

As a manufacturer of eco-friendly tableware in China for over a decade, this news hit our industry like an earthquake. In a world that desperately needs to move away from plastic, this feels like a huge step backward. This policy, a remnant of a more protectionist trade era, creates a major roadblock for the environmental movement3. While it's framed as a move to protect local industry, it forces American consumers to pay more for green alternatives and slows down our collective progress. Let's break down exactly why this happened and what the fallout will be.

What is the official reason for such a high tariff?

You hear "540% tariff4" and it sounds extreme, almost random. Why would the U.S. government target an eco-friendly product with such an aggressive measure?

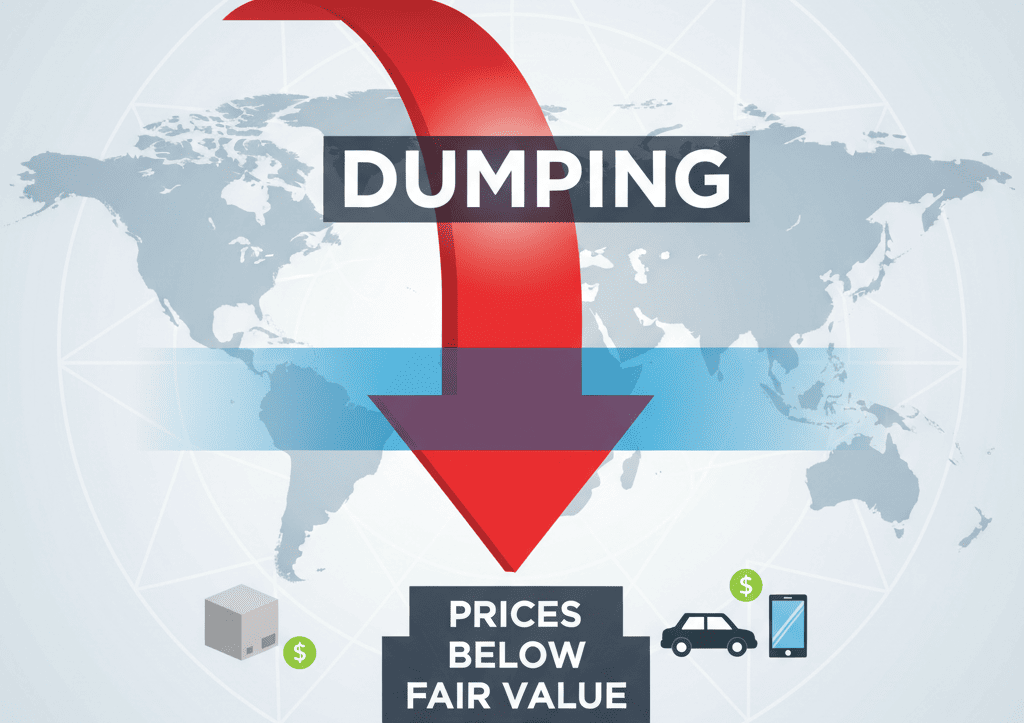

The official reason is a U.S. Department of Commerce ruling on "anti-dumping5" and "countervailing duties6". It concluded that Chinese producers were selling goods below fair market value and receiving state subsidies, causing "material injury7" to U.S. producers.

This isn't just a simple tax; it's a specific trade remedy. The investigation found that Chinese companies were able to sell their products so cheaply because of unfair advantages. "Dumping" is when a product is sold in an export market for less than it costs to make or for less than it's sold domestically. "Countervailing duties" are meant to offset direct government subsidies that give those companies an unfair edge. When U.S. manufacturers showed that this competition was causing them significant financial harm—or "material injury7"—the government was authorized to impose these massive duties to level the playing field. From my perspective, this move ignores the benefits of global trade, which allows consumers to access affordable goods.

Understanding the Official Terms

| Term | What It Means | The U.S. Government's Claim |

|---|---|---|

| Anti-Dumping (AD) | A duty to punish selling goods abroad for less than their home market price or cost of production. | Chinese tableware was sold in the U.S. at unfairly low prices. |

| Countervailing Duty (CVD) | A duty to offset subsidies from a foreign government that benefit producers. | Chinese manufacturers received state subsidies, lowering their costs unfairly. |

| Material Injury | Proof that the dumping and subsidies caused real financial harm to the domestic industry. | U.S. producers proved they were losing sales and market share. |

How will this tariff immediately affect the market?

You understand the "why," but what does this mean for the products on the shelf right now? How does a 540% tariff actually change things overnight?

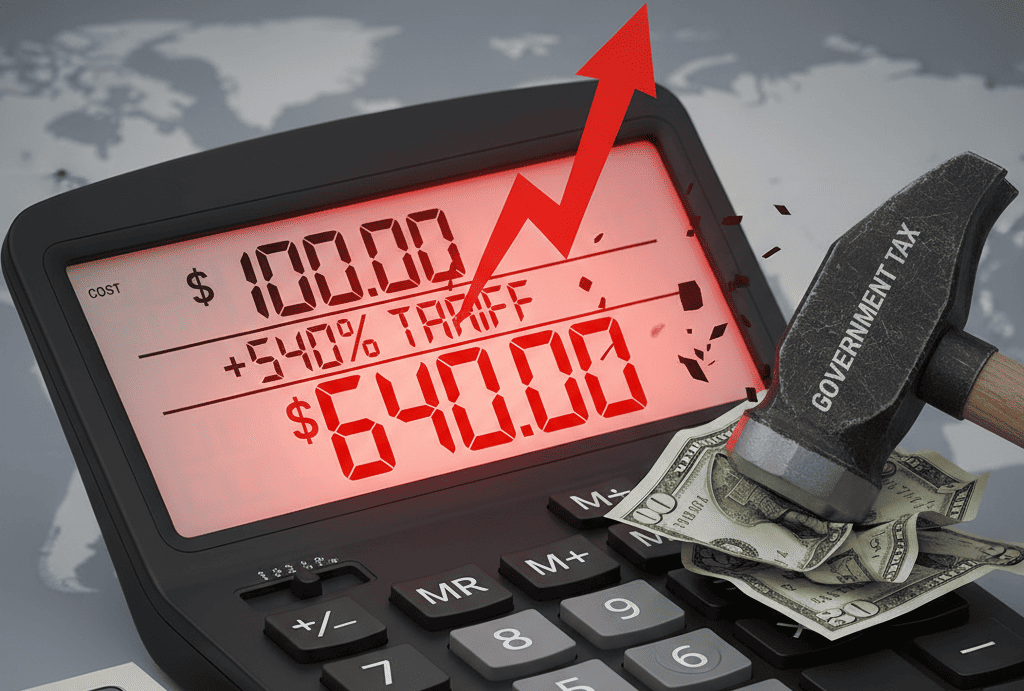

It means U.S. importers must immediately pay a massive cash deposit8 equal to the duty rate when the goods arrive. This instantly makes most Chinese eco-friendly tableware too expensive to import and sell profitably.

The effect is not gradual; it's a sudden financial shock. Imagine an importer was buying a container of bagasse plates from us for $20,000. With a 540% tariff, they would have to put down an additional cash deposit8 of $108,000 just to get the products into the country. This makes the landed cost of the product impossible to justify. No distributor can absorb that kind of increase, and no consumer would buy a pack of disposable plates9 at such an inflated price. As a result, import volumes10 from China are expected to drop to almost zero. Distributors are now scrambling to find new suppliers, and the entire supply chain is in chaos.

Here is the immediate chain reaction:

- Importers are required to pay the massive cash deposit upfront.

- The total cost to bring the product into the U.S. becomes unsustainable.

- U.S. buyers cancel their orders from Chinese manufacturers like me.

- The availability of these specific imported products in the U.S. market will plummet.

Who really wins and who loses from this tariff?

A tariff is designed to help someone. But in a global economy, is it possible that such a move creates more losers than winners, especially for a green product?

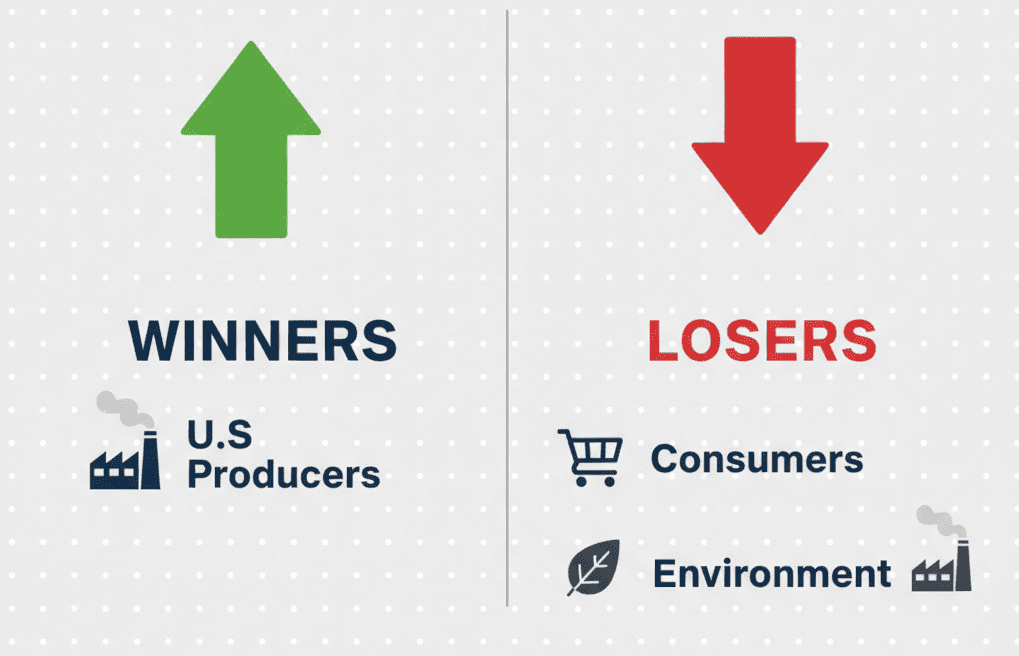

U.S. manufacturers are the clear winners, as they are now shielded from lower-priced competition. The biggest losers are U.S. consumers11, who face higher prices, and the environment, as the shift away from plastic may slow down.

This is the core of my frustration with this policy. It's a classic case of protectionism12 that helps a small group at the expense of the wider public good. U.S. producers will absolutely benefit. They can now raise their prices, increase their orders, and potentially invest in expanding their factories. But this comes at a huge cost. Consumers who want to make an eco-conscious choice will have to pay more for it. For price-sensitive businesses like restaurants or schools, this could make compostable tableware unaffordable, forcing them to stick with or even go back to cheaper plastic and foam alternatives13. This is a direct blow to our shared environmental goals.

The Winners vs. The Losers

| Group | Effect | Why It Happens |

|---|---|---|

| WINNERS: U.S. Manufacturers | Price relief, increased orders, more investment. | Competition from lower-priced imports is eliminated. |

| LOSERS: U.S. Consumers | Higher prices for eco-friendly tableware. | Less competition and higher import costs drive up retail prices. |

| LOSERS: The Environment | Slower adoption of compostable products. | Higher costs may push buyers back to non-recyclable plastic or foam. |

| LOSERS: Chinese Manufacturers | Loss of a major export market. | Products are priced out of the U.S., leading to factory shutdowns and job losses. |

What long-term changes will this policy drive in the industry?

This tariff is a huge shock to the system. Beyond the immediate chaos, what lasting changes will we see in the sustainable packaging industry14 years from now?

This policy will accelerate investment in U.S. domestic production, especially for PFAS-free fiberware. It will also push businesses toward reusables and force tighter enforcement to prevent illegal trade route manipulation.

While the tariff is painful, it will force a major restructuring of the market. The most significant long-term effect will be a pivot toward American-made products. We will see more investment in U.S. factories that produce molded fiber tableware. These new domestic players will likely market themselves heavily as being "PFAS-free" to stand out. At the same time, the high cost of single-use items will force many foodservice operators to seriously consider reusable plates and containers to control their expenses. Finally, expect U.S. Customs to get much stricter about enforcement. They will crack down on "transshipment15"—where companies try to illegally route Chinese goods through another country like Vietnam or Malaysia to hide their true origin and avoid the tariff.

Key long-term shifts will include:

- A surge in U.S. domestic manufacturing of fiber-based tableware.

- Increased focus on reusables in the foodservice sector as a cost-control measure.

- Tighter compliance and documentation to combat illegal transshipment15.

- Higher overall market prices for single-use compostable tableware in the U.S.

Conclusion

This tariff aims to protect the U.S. industry, but it does so by raising prices for consumers and creating a setback for the environmental movement3's fight against single-use plastics.

Explore this resource to understand how tariffs affect prices and the environment, crucial for informed consumer choices. ↩

Learn about the popularity of these products and their role in sustainable practices. ↩

Understanding the environmental movement can help consumers make more sustainable choices. ↩

Understanding the implications of such a high tariff can help consumers and businesses navigate the changing market. ↩

Gain insights into anti-dumping measures and their effects on global trade dynamics. ↩

Understanding countervailing duties can clarify how governments protect local industries. ↩

Explore the concept of material injury to understand its significance in trade policies. ↩

Learn about cash deposits and their role in international trade and tariffs. ↩

Learn about the environmental consequences of using disposable plates to make informed choices. ↩

Understanding the relationship between tariffs and import volumes can inform future trade decisions. ↩

Explore this resource to understand the broader implications of tariffs on U.S. consumers and their choices for sustainable products. ↩

Explore this resource to understand how protectionism impacts global trade dynamics and environmental sustainability. ↩

Explore this resource to understand how tariffs affect product pricing and consumer choices in the eco-friendly market. ↩

Discover the latest trends shaping the sustainable packaging industry for future insights. ↩

Learn about transshipment and its implications for trade compliance and tariffs. ↩